-

2025 Homeowner’s Guide: Tax Credit for Solar Panels

The Federal Tax Credit Solar Panels Also known as the Investment Tax Credit (ITC), is one of the most powerful federal tax credit for homeowners investing in solar panels. Designed to make clean energy more accessible, this tax credit helps reduce upfront costs for solar photovoltaic (PV) systems, making renewable energy a reality for millions…

-

Commercial Solar Energy Systems

Cut Business Costs by 30% Within the First Year Switching to commercial solar energy isn’t just about going green; it’s about significant cost savings for your business. Did you know that businesses using solar can be eligible for a tax credit of up to 30% just by switching to solar? From small businesses to large…

-

Commercial Solar Financing + Government Incentives

Exploring commercial solar financing and government incentives can be a transformative step for businesses looking to invest in renewable energy. The combination of attractive tax credits and specialized financing solutions significantly lowers costs and enhances the feasibility of solar projects. Let’s dive into the various options available that can make solar energy not only accessible,…

-

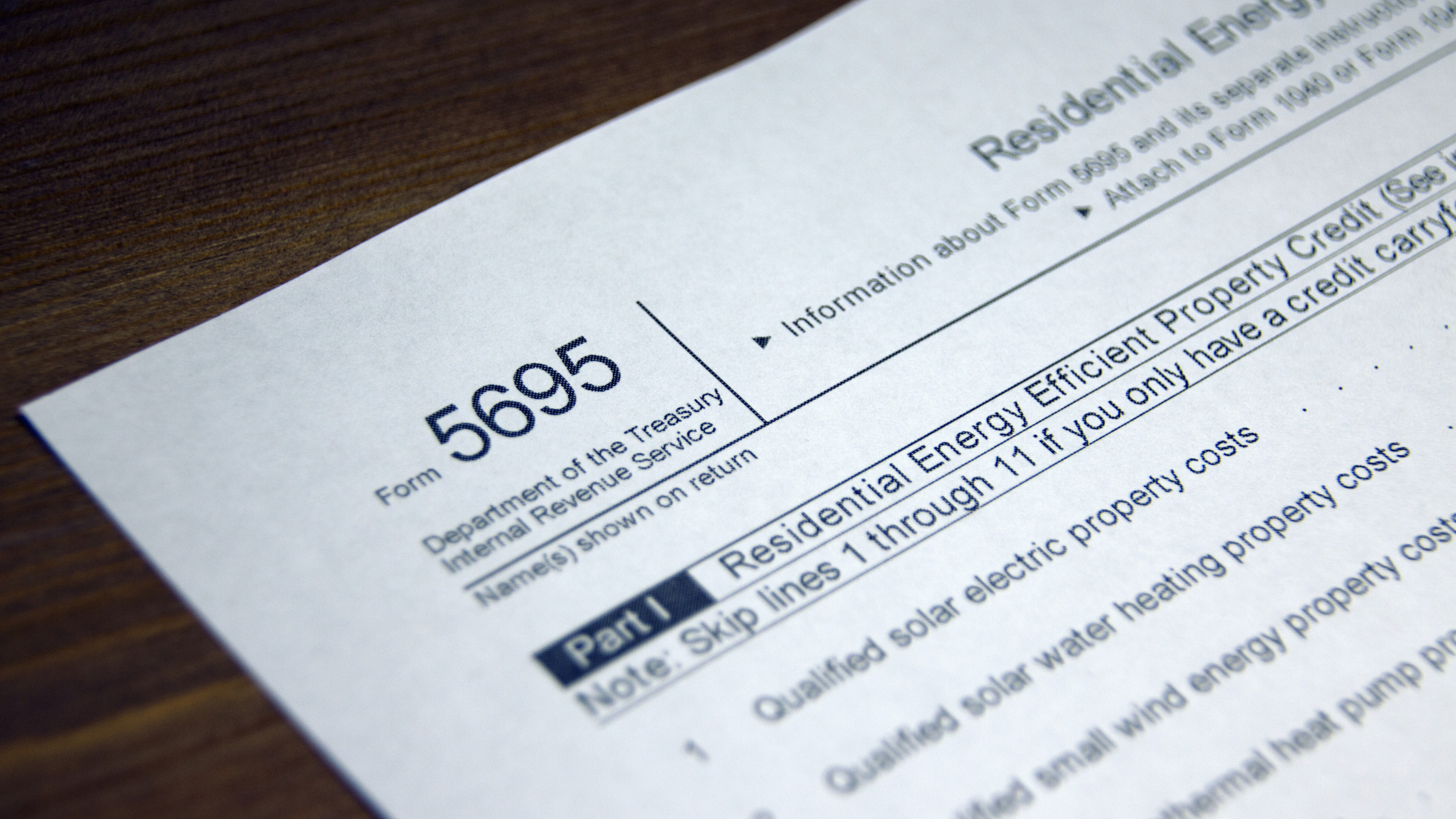

Navigating IRS Form 5695 and the Solar Tax Credit

Harnessing solar energy not only benefits the environment but also offers significant financial advantages through tax incentives. The Solar Tax Credit, accessible via IRS Form 5695, is a crucial financial tool for homeowners who have invested in solar energy. This comprehensive guide walks you through the necessary steps to claim your Solar Tax Credit effectively.…